Here are the main points you need to know from the Federal Budget

By Caitlin Davidovic and Leonie Taylor

Tackling inflation was top of the agenda as Treasurer Jim Chalmers handed down Labour’s 2022-23 budget on Tuesday 25 October 2022.

After inflation hitting its highest point since 1990, Australians are feeling the cost-of-living pressures, deeply impacting household budgets. Inflation is expected to peak at a high of 7.75% towards the end of 2022, before moderating to 3.5% through 2023-24 and return to the Reserve Bank’s target rate in 2024-25.

As part of Labour’s pre-election promise, a five-point plan was delivered in the budget to provide cost-of-living relief with policies that are affordable, fair and future focused. These policies were to:

Provide cheaper childcare.

Expand paid parental leave.

Provide cheaper medicines.

Provide affordable housing.

Get wages moving again.

The $7.5 billion package was to help put money back in Australians pockets, boost productivity as well as grow the economy whilst being timed carefully to avoid putting pressure on inflation.

The key points from this budget are:

For Families - Relief for Cost of Living, Paid Parental Leave Extension and cost of medicine reduction.

Paid parental leave is expanding to increase from 20 weeks to 26 weeks, adding 2 weeks each year from July 2024 to July 2026.

From July 2023, the maximum childcare subsidy rates are increasing from 85% to 90%. Families earning under $80,000 will be able to receive the full 90% and the cut off family income being $530,000.

The maximum co-payment for scripts under the PBS scheme is decreasing from $42.50 to $30.00.

Assets test exemption for downsizing homes is now for 48 months. Income sale proceeds will be deemed at 0.25% for 24 months.

Deeming rates are frozen for 2 years.

Housing Affordability

A target of 1 million new homes is expected to be delivered over the course of 5 years, starting from mid-2024.

The government will be establishing a Housing Australia Future Fund. Returns from the fund will be used to build 30,000 new dwellings over the next 5 years.

Education:

Deliverance of 480,000 fee-free TAFE and community-based vocational education places over 4 years. Please see this fact sheet for further information.

Implementation of a $50 million technology fund to modernise TAFEs across Australia.

There was not a lot to report in the way of tax reform. However here are some important measures to note:

Personal Tax – Rates, thresholds and offsets)

The Low and Middle Income Tax Offset was increased by $420 for the 2021/2022 year, bringing the maximum offset to $1,500. This will not be extended beyond the 2021/2022 tax year. There will be no changes to tax rates in the 2023 and 2024 financial years.

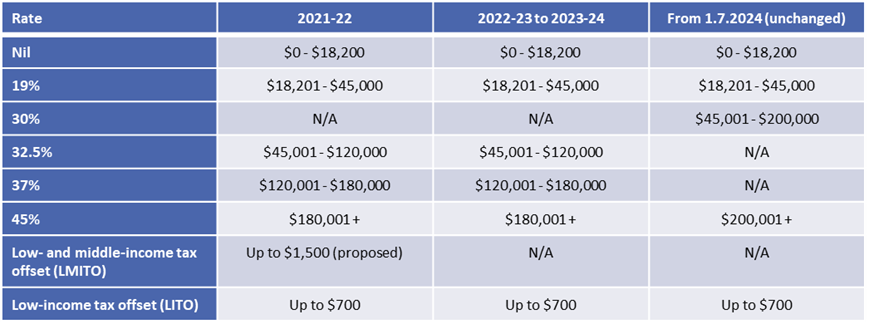

Below is a summary outlining the resident rates and thresholds for the next 3 years.

Note: The tax rates for foreign residents and working holiday makers remain unchanged for the 2022-23 financial year.

However changes the income thresholds occur for the 2024-25 financial year and later income years.

Superannuation Guarantee

There is no change to the super guarantee legislation with rate rises remaining the same being 10.5% in 2022 and gradually rising to 12% in 2026.

Business

Small businesses will still be able to deduct 120% on business expenses and depreciating assets that support digital uptake and external training. Note that the extra 20% can’t be claimed until the following year

There will be a FBT exemption for electric vehicles under the luxury car tax threshold of $84,916. The vehicle must’ve been held/used before 1 July 2022. See some examples here.

Penalties

There will be an increase in Commonwealth Penalty Unit from $222 to $275 as of 1 July 2023.

$30.4 million to be provided to the Tax Practitioners Board over 4 years to increase compliance investigations into high-risk tax practitioners and unregistered preparers.

It appears that Labour has a lot on its hands with the major task of relieving household pressures as well as reining in budget deficits. For now, many have described the 2022-23 budget as sensible under the current economic conditions.

Further solidarity regarding Tax Reform is expected to come in the next year’s Budget due in May 2023.

If you would like to discuss any measures of the budget in further details, please speak with your Accountant or Manager, call us on 9841 1200 or email us at info@lincolns.com.au.

Lincolns EOFY in Pictures

In mid-October we took some time out to explore the Horsepower Highway and attend the official opening of "Lumpy - The Blue Tractor" for Mental Health Week WA. We are incredibly proud to sponsor this installation and feel strongly about the message it portrays: "You bogged mate? There's no shame in asking for hand out."

What a wonderful afternoon out connecting with each other and the community and thinking of those touched by mental health struggles.

Big thanks to Cassy and The Horsepower Highway committee, Garry and Nola Bungey of Highdenup Farms for donating the original body wreck, Wilson WA Pty Ltd for the restoration work and artists Glenn Hegedus and Brad Lucas. Thanks also to Mt Trio Bush Camp & Caravan Park for hosting us for the afternoon and educating us on a beautiful wildflower walk.

Coffee with … Ricarda Loecker (Part 1)

If you are local to Albany, the name Ricarda may sound familiar to you due to her flagship fashion and homewares store on York Street.

While we normally focus on the business in these articles, as we started to talk to Ricarda and her life story unfolded, we realised there was so much more to her story than her current business. For this reason we decided to do this as a two part series.

Part 1 of the series looks at Ricarda’s childhood, her upbringing and her entry into the fashion industry.